Shares of The Hershey Company (NYSE: HSY) rose 1.60% on Friday to $217.31, outperforming the S&P 500 Index, which rose 0.67%. The Dow Jones Industrial Average also rose 0.73%.

The gains for Hershey come after the company reported strong earnings results for the second quarter of 2023. The company reported earnings per share of $1.80, beating analysts’ expectations of $1.74. Revenue for the quarter was also above expectations, coming in at $2.34 billion.

Hershey attributed the strong results to strong demand for its products, particularly in the United States. The company also said that it benefited from higher prices.

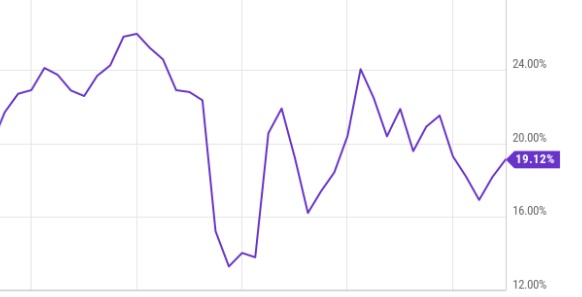

The company’s shares have been on a tear in recent months, rising more than 20% since the beginning of the year. The stock is now trading near its all-time high.

Analysts are bullish on Hershey, with the average price target for the stock being $230.00. The company is expected to report earnings per share of $7.26 for the full year 2023.

The strong earnings results and bullish analyst sentiment are likely to support Hershey’s stock price in the near future. The company is well-positioned to continue to grow its business in the years to come.

Here are some of the factors that could drive Hershey’s stock price in the future:

* Continued strong demand for its products, particularly in the United States.

* Expansion into new markets, such as China and India.

* Acquisitions of other confectionery companies.

* Innovation in new products and packaging.

* Cost savings from operational efficiencies.

Overall, Hershey is a well-run company with a strong track record of growth. The company is likely to continue to outperform the market in the years to come.